Chapter 13 car loan modification information

Home » modification » Chapter 13 car loan modification informationYour Chapter 13 car loan modification images are ready in this website. Chapter 13 car loan modification are a topic that is being searched for and liked by netizens today. You can Download the Chapter 13 car loan modification files here. Find and Download all royalty-free images.

If you’re looking for chapter 13 car loan modification images information related to the chapter 13 car loan modification keyword, you have visit the right site. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Chapter 13 Car Loan Modification. However there are exceptions to the power to modify liens in chapter 13 that are so extensive they threaten to swallow the general rule that liens can be modified. Cramdowns are only available in Chapter 13 bankruptcy. Its not at all unusual for a borrower to file a Chapter 13 case to stop a foreclosure and then apply to the mortgage company to modify the terms of the loan. This means that they owe more on the car than the car is worth.

Mortgage Loan Modification And Bankruptcy From thebalance.com

Mortgage Loan Modification And Bankruptcy From thebalance.com

This means that they owe more on the car than the car is worth. Honest and straight forward terms. In Chapter 13 bankruptcy it is often possible to pay the lender what the car is worth rather than the full balance of the loan. The procedures you must follow to ask the trustee and court for permission to incur new debt vary so check with your Chapter 13 trustee or attorney to find out the specific procedures required in your bankruptcy court. Below weve outlined a typical process for getting a new car loan. However you must obtain court permission to complete the process.

Generally liens can be modified in chapter 13 case but cannot be modified in a chapter 7 case.

While you are in an active Chapter 13 bankruptcy you cannot incur new debt without permission from the Bankruptcy Court. Cramdown your loan During a Chapter 13 you may be able to reduce the amount you owe on your car to its current value. Florida residents who have filed for Chapter 13 bankruptcy might qualify for what is known as a loan cramdown on their car. However you cant do this if your auto loan is less than two and a half years old. The answer is yes. Ad We offer Loan against StockSharesPenny Stock Worldwide.

Source: lendingtree.com

Source: lendingtree.com

Honest and straight forward terms. However you must obtain court permission to complete the process. The anti-modification prohibition of Chapter 13 in Section 1322 b 2 of the Code provides that subject to subsections a and c of this section the plan may modify the rights of holders of secured claims other than a claim secured only by a security interest in real property that is. Key Points of This Article. Generally liens can be modified in chapter 13 case but cannot be modified in a chapter 7 case.

Source: floridalegaladvice.com

Source: floridalegaladvice.com

This is called lien stripping. Please contact your bankruptcy attorney and request a release form allowing the mortgage company to. If a person is otherwise eligible for either a chapter 7 or 13 I usually dont recommend doing a 13 for the sole reason of modifying a car loan. Chapter 13s cost more and theres always the chance that the vehicle wont last or that there are other circumstances where you cant afford it anymore in which case youre probably better off in chapter 7. The answer is yes.

Source: gallerlaw.com

Source: gallerlaw.com

Its not at all unusual for a borrower to file a Chapter 13 case to stop a foreclosure and then apply to the mortgage company to modify the terms of the loan. Ad We offer Loan against StockSharesPenny Stock Worldwide. Any amount over the value becomes unsecured debt and is repaid or wiped out during bankruptcy. Lien must be paid off. Cramdown your loan During a Chapter 13 you may be able to reduce the amount you owe on your car to its current value.

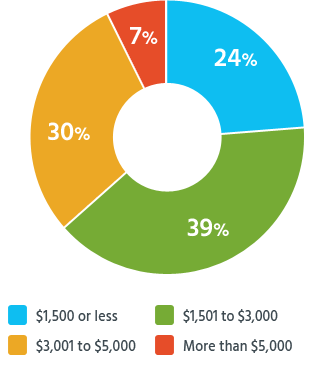

For homes and residences section 1322b2 prevents chapter 13 plans from modifying claims secured only by an interest in real property that is the debtors principal residence In short if the collateral is the debtors home the debtor cannot use chapter 13 to force the creditor to modify the terms of the mortgage. Chapter 13 payment plans generally last from 3 to 6 years based on your gross income. Try us once to know us better. Limitations You must pay particular debts in your Chapter 13 plan including some taxes and all domestic support obligations these are priority debts as well as any mortgage arrears on properties you wish to keep. There are two other requirements for a cramdown.

Source: thebalance.com

Source: thebalance.com

Individuals who file Chapter 13 with car loans that are about 25 years old can repay the loan based upon the value of the vehicle rather than the balance of the loan. Cramdowns are only available in Chapter 13 bankruptcy. Ad We offer Loan against StockSharesPenny Stock Worldwide. In Chapter 13 bankruptcy it is often possible to pay the lender what the car is worth rather than the full balance of the loan. If a person is otherwise eligible for either a chapter 7 or 13 I usually dont recommend doing a 13 for the sole reason of modifying a car loan.

Source: nolo.com

Source: nolo.com

Ad We offer Loan against StockSharesPenny Stock Worldwide. Applying for a Mortgage Modification Even though youre paying mortgage arrearages through a Chapter 13 plan you can still work with your lender to modify your mortgage. There are two other requirements for a cramdown. However there are exceptions to the power to modify liens in chapter 13 that are so extensive they threaten to swallow the general rule that liens can be modified. You cannot do this to a mortgage in a Chapter 7 case.

Source: br.pinterest.com

Source: br.pinterest.com

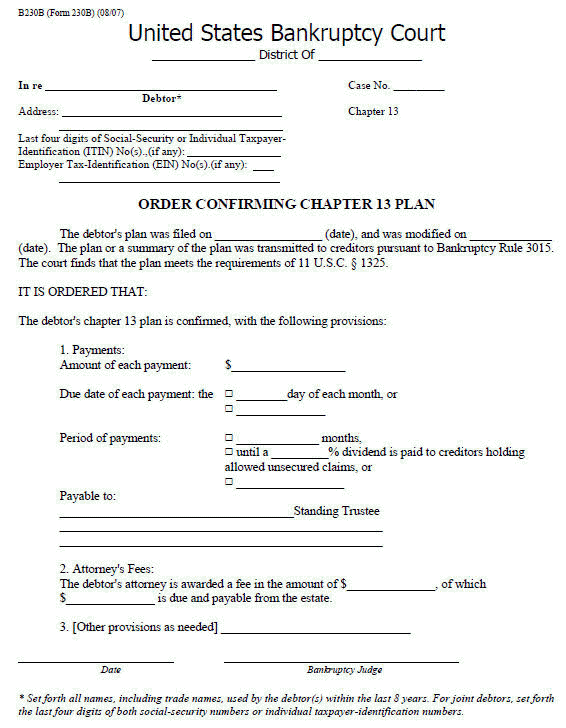

The anti-modification prohibition of Chapter 13 in Section 1322 b 2 of the Code provides that subject to subsections a and c of this section the plan may modify the rights of holders of secured claims other than a claim secured only by a security interest in real property that is. Furthermore the court-approved repayment plan must. If your vehicle loan is over two-and-a-half years old and the remaining loan balance is greater than the car or trucks current value Chapter 13 could provide an opportunity to lower the remaining loan amount and interest rate and then pay the loan off as part of your approved bankruptcy plan monthly payment. This is called lien stripping. However you must obtain court permission to complete the process.

Source: floridalegaladvice.com

Source: floridalegaladvice.com

While you are in an active Chapter 13 bankruptcy you cannot incur new debt without permission from the Bankruptcy Court. Florida residents who have filed for Chapter 13 bankruptcy might qualify for what is known as a loan cramdown on their car. Lien must be paid off. Can I Get A Loan Modification While In A Chapter 13 Bankruptcy. Below weve outlined a typical process for getting a new car loan.

Source: gallerlaw.com

Source: gallerlaw.com

You pay the new lower amount in 36 to 60 months through your Chapter 13 plan. You can obtain a loan modification of your mortgage while you are in an active Chapter 13 bankruptcy. Any amount over the value becomes unsecured debt and is repaid or wiped out during bankruptcy. Chapter 13 payment plans generally last from 3 to 6 years based on your gross income. Limitations You must pay particular debts in your Chapter 13 plan including some taxes and all domestic support obligations these are priority debts as well as any mortgage arrears on properties you wish to keep.

Source: richardacheck.com

Source: richardacheck.com

Applying for a Mortgage Modification Even though youre paying mortgage arrearages through a Chapter 13 plan you can still work with your lender to modify your mortgage. Honest and straight forward terms. Furthermore the court-approved repayment plan must. The procedures you must follow to ask the trustee and court for permission to incur new debt vary so check with your Chapter 13 trustee or attorney to find out the specific procedures required in your bankruptcy court. Any amount over the value becomes unsecured debt and is repaid or wiped out during bankruptcy.

Source: alperlaw.com

Source: alperlaw.com

Below weve outlined a typical process for getting a new car loan. Honest and straight forward terms. People must have owned the car for at least 910 days. You pay the new lower amount in 36 to 60 months through your Chapter 13 plan. The procedures you must follow to ask the trustee and court for permission to incur new debt vary so check with your Chapter 13 trustee or attorney to find out the specific procedures required in your bankruptcy court.

Source: apsanlaw.com

Source: apsanlaw.com

You May Be Able to Cram Down Your Car Loan in Chapter 13 If you satisfy certain conditions you can reduce the principal balance of your car loan to the cars fair market value in Chapter 13 bankruptcy. Honest and straight forward terms. People must have owned the car for at least 910 days. The anti-modification prohibition of Chapter 13 in Section 1322 b 2 of the Code provides that subject to subsections a and c of this section the plan may modify the rights of holders of secured claims other than a claim secured only by a security interest in real property that is. Furthermore the court-approved repayment plan must.

Source: pinterest.com

Source: pinterest.com

Limitations You must pay particular debts in your Chapter 13 plan including some taxes and all domestic support obligations these are priority debts as well as any mortgage arrears on properties you wish to keep. Cramdowns are only available in Chapter 13 bankruptcy. Try us once to know us better. If your vehicle loan is over two-and-a-half years old and the remaining loan balance is greater than the car or trucks current value Chapter 13 could provide an opportunity to lower the remaining loan amount and interest rate and then pay the loan off as part of your approved bankruptcy plan monthly payment. The anti-modification prohibition of Chapter 13 in Section 1322 b 2 of the Code provides that subject to subsections a and c of this section the plan may modify the rights of holders of secured claims other than a claim secured only by a security interest in real property that is.

Source: thismatter.com

Source: thismatter.com

Its not at all unusual for a borrower to file a Chapter 13 case to stop a foreclosure and then apply to the mortgage company to modify the terms of the loan. Please contact your bankruptcy attorney and request a release form allowing the mortgage company to. There are two other requirements for a cramdown. You pay the new lower amount in 36 to 60 months through your Chapter 13 plan. Any amount over the value becomes unsecured debt and is repaid or wiped out during bankruptcy.

Source: investopedia.com

Source: investopedia.com

Ad We offer Loan against StockSharesPenny Stock Worldwide. Cramming down your car loan balance in Chapter 13 reduces the balance to the vehicles fair market value. Florida residents who have filed for Chapter 13 bankruptcy might qualify for what is known as a loan cramdown on their car. Honest and straight forward terms. Try us once to know us better.

Source: preventloanscams.org

Source: preventloanscams.org

Cramdowns are only available in Chapter 13 bankruptcy. You pay the new lower amount in 36 to 60 months through your Chapter 13 plan. Try us once to know us better. Individuals who file Chapter 13 with car loans that are about 25 years old can repay the loan based upon the value of the vehicle rather than the balance of the loan. Lien must be paid off.

Source: co.pinterest.com

Source: co.pinterest.com

Generally liens can be modified in chapter 13 case but cannot be modified in a chapter 7 case. Lien must be paid off. You can obtain a loan modification of your mortgage while you are in an active Chapter 13 bankruptcy. Try us once to know us better. Limitations You must pay particular debts in your Chapter 13 plan including some taxes and all domestic support obligations these are priority debts as well as any mortgage arrears on properties you wish to keep.

Source: thebalance.com

Source: thebalance.com

This means that they owe more on the car than the car is worth. For homes and residences section 1322b2 prevents chapter 13 plans from modifying claims secured only by an interest in real property that is the debtors principal residence In short if the collateral is the debtors home the debtor cannot use chapter 13 to force the creditor to modify the terms of the mortgage. By following standards outlined in the Bankruptcy Code you can reclassify that loan on your home into the same category as credit cards or other ordinary bills and discharge them at the end of your Chapter 13 payment plan. People must have owned the car for at least 910 days. Chapter 13 payment plans generally last from 3 to 6 years based on your gross income.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title chapter 13 car loan modification by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Leatherman modification ideas

- Organizational behavior modification theory ideas

- Seamoth modification station location information

- Custody modification reasons information

- Kak shockwave modification information

- Subnautica cant place vehicle modification station information

- Loan modification while in chapter 13 information

- Behavior modification is based upon the principles of rewards and punishments advanced by ideas

- Modification lawyer information

- Z4 modification information