Spousal support modification california ideas

Home » modification » Spousal support modification california ideasYour Spousal support modification california images are ready. Spousal support modification california are a topic that is being searched for and liked by netizens today. You can Get the Spousal support modification california files here. Get all free photos.

If you’re searching for spousal support modification california pictures information connected with to the spousal support modification california keyword, you have pay a visit to the right blog. Our website always gives you hints for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Spousal Support Modification California. The Ability to Modify Spousal Support California Orders California Family Code Sections 3603 3651 c and 4333 provide that temporary as well as permanent spousal support awards and agreements can be modified during the period support is scheduled to be paid except if the parties have signed a written stipulation and agreed otherwise. Changes to Laws - Changes to family law in California or State or Federal tax Laws could result in changes to spousal support payment amounts. If the spouses are on good terms they may mutually agree to modify the support amount. That is because the court does not have the power to make any downward modification of spousal support unless you can show the court that there has been a material change of circumstance since the most recent order.

Emergency Rule 13 Spousal Support California S Covid 19 Solution From kasparlugay.com

Emergency Rule 13 Spousal Support California S Covid 19 Solution From kasparlugay.com

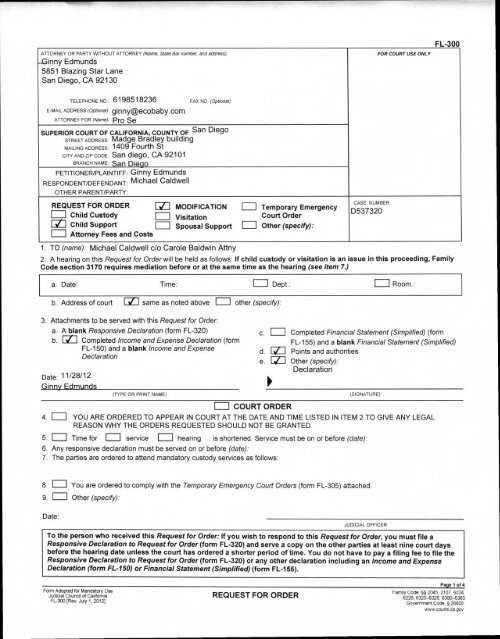

This form asks you to provide the information the judge will need to make a decision in your case addressing all the factors the law tells the judge to. According to the California courts website spousal support can be modified when it can be proven that there has been a change in circumstances since the order was made. Spousal support orders may be temporary or they be what is called permanent. If an agreement between the parties cannot be reached on the issue of a modification of spousal support the requesting party must file a Request for Order with the Court. Emergency Rule 13 is designed to help these people file for support modifications without losing time due to court closures. Unless the state tax laws are changed spousal support payments will continue to be tax deductible for the person who pays and taxable as income to the person who receives spousal support after December 31 2018.

There are a wide-range of reasons why spousal support may need to be modified.

The court will decide on whether spousal support payments are appropriate and the amounts involved on these payments based on several factors laid out in California law. Spousal support orders may be temporary or they be what is called permanent. Its clear that the pandemic has caused serious difficulties for many people throughout California. Emergency Rule 13 is designed to help these people file for support modifications without losing time due to court closures. Modifying Temporary Spousal Support Orders. Anything or anyone saying California requires lifetime support is false.

Source: sdesquire.com

Source: sdesquire.com

One common question that divorce lawyers hear is. The guideline states that the payor spouse should contribute presumptively 40 of his or her net monthly income reduced by one-half of. The court will decide on whether spousal support payments are appropriate and the amounts involved on these payments based on several factors laid out in California law. Spousal support orders may be temporary or they be what is called permanent. In this case they should draft a written modification sign it and submit the modification to a judge.

Source: renkinlaw.com

Source: renkinlaw.com

Spousal support which is not usually referred to as alimony in California is available in dissolution proceedings actions for legal separation and in connection with domestic violence applications. According to the California courts website spousal support can be modified when it can be proven that there has been a change in circumstances since the order was made. This form asks you to provide the information the judge will need to make a decision in your case addressing all the factors the law tells the judge to. If an agreement between the parties cannot be reached on the issue of a modification of spousal support the requesting party must file a Request for Order with the Court. Spousal support orders may be temporary or they be what is called permanent.

Source: apeopleschoice.com

Source: apeopleschoice.com

Changes to Laws - Changes to family law in California or State or Federal tax Laws could result in changes to spousal support payment amounts. California tax laws are not the same as federal tax laws about spousal support. Spousal support which is not usually referred to as alimony in California is available in dissolution proceedings actions for legal separation and in connection with domestic violence applications. The amount of temporary support payments is often based on formulas set out by each. Anything or anyone saying California requires lifetime support is false.

Source: irwinirwin.com

Source: irwinirwin.com

Spousal support which is not usually referred to as alimony in California is available in dissolution proceedings actions for legal separation and in connection with domestic violence applications. Unless the state tax laws are changed spousal support payments will continue to be tax deductible for the person who pays and taxable as income to the person who receives spousal support after December 31 2018. For example a spouse may not request a modification on a support order that states it cannot be modified. For marriages lasting less than 10 years the duration of support is generally presumed to be half of the time spent. The amount of temporary support payments is often based on formulas set out by each.

Source: cadivorce.com

Source: cadivorce.com

The guideline states that the payor spouse should contribute presumptively 40 of his or her net monthly income reduced by one-half of. If the spouses are on good terms they may mutually agree to modify the support amount. When to Request California Spousal Support Modification. Identifying a material change of circumstances is a critical part of any spousal support reduction request in California. Whenever the court orders spousal support each partner must know and understand the exact terms of the order.

Source: sdesquire.com

Source: sdesquire.com

California law allows for two types of spousal support one of which is temporary support that is paid while the divorce case is pending. This includes people who have spousal or child support orders in place. According to a California court case In re Marriage of Reynolds 1998 a spouse paying spousal support pursuant to a California support order cannot be compelled to work after the standard retirement age of 65 in order to continue paying support at the same level heshe had been paying prior to reaching said standard retirement age. The amount of temporary support payments is often based on formulas set out by each. According to the California courts website spousal support can be modified when it can be proven that there has been a change in circumstances since the order was made.

Source: orangecountyfamilylaw.com

Source: orangecountyfamilylaw.com

For marriages lasting less than 10 years the duration of support is generally presumed to be half of the time spent. Remarriage - If a former spouse who receives spousal support remarries the other spouse who was paying the spousal support may argue that there is no more need to continue paying support. The amount of temporary support payments is often based on formulas set out by each. Whenever the court orders spousal support each partner must know and understand the exact terms of the order. This includes people who have spousal or child support orders in place.

Source: renkinlaw.com

Source: renkinlaw.com

According to the California courts website spousal support can be modified when it can be proven that there has been a change in circumstances since the order was made. One common question that divorce lawyers hear is. Identifying a material change of circumstances is a critical part of any spousal support reduction request in California. For marriages lasting less than 10 years the duration of support is generally presumed to be half of the time spent. Unless the state tax laws are changed spousal support payments will continue to be tax deductible for the person who pays and taxable as income to the person who receives spousal support after December 31 2018.

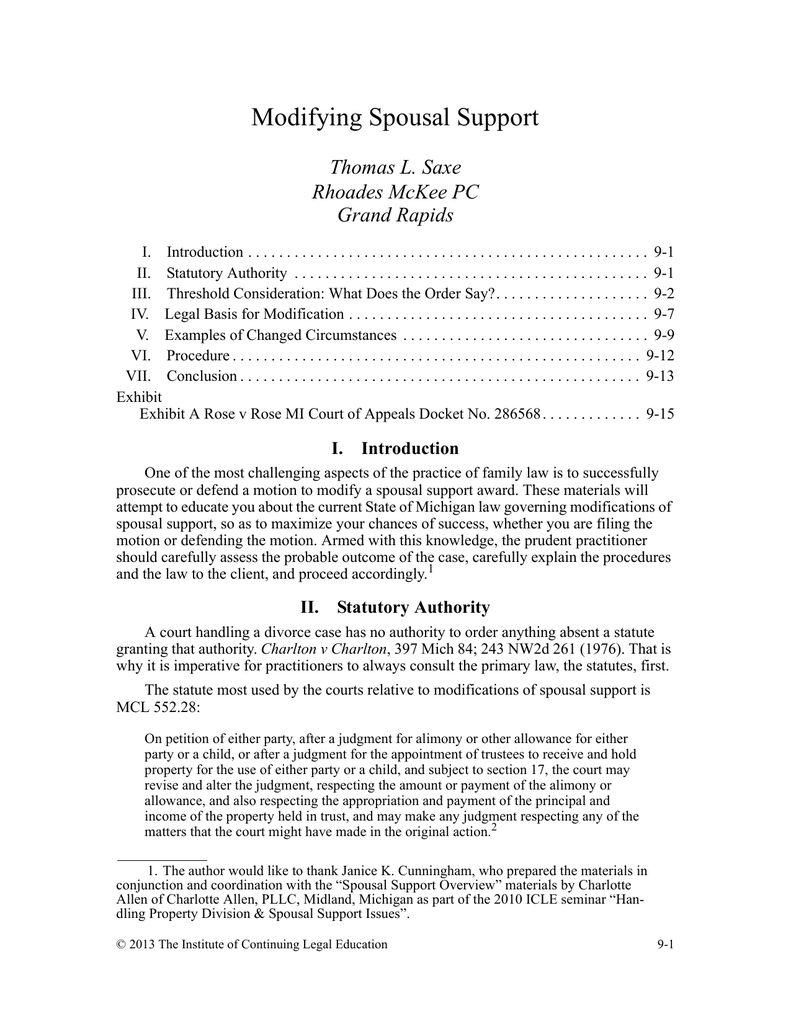

Source: studylib.net

Source: studylib.net

Increase in Spousal Support. Spousal support which is not usually referred to as alimony in California is available in dissolution proceedings actions for legal separation and in connection with domestic violence applications. The Ability to Modify Spousal Support California Orders California Family Code Sections 3603 3651 c and 4333 provide that temporary as well as permanent spousal support awards and agreements can be modified during the period support is scheduled to be paid except if the parties have signed a written stipulation and agreed otherwise. In California the family courts have adopted a spousal support guideline for calculating temporary pre-judgment spousal support. California tax laws are not the same as federal tax laws about spousal support.

Source: survivedivorce.com

Source: survivedivorce.com

If the spouses are on good terms they may mutually agree to modify the support amount. Spousal support orders may be temporary or they be what is called permanent. This includes people who have spousal or child support orders in place. Increase in Spousal Support. California law allows for two types of spousal support one of which is temporary support that is paid while the divorce case is pending.

Source: sdesquire.com

Source: sdesquire.com

How long does spousal support last in California The duration of support depends on how long the marriage has lasted and assumes a reasonable transition period from married life to single self-sufficient life. A Request for Order is a motion wherein the requesting party requests that the Court order a specific ruling such as an increase in spousal support. Anything or anyone saying California requires lifetime support is false. Identifying a material change of circumstances is a critical part of any spousal support reduction request in California. The Ability to Modify Spousal Support California Orders California Family Code Sections 3603 3651 c and 4333 provide that temporary as well as permanent spousal support awards and agreements can be modified during the period support is scheduled to be paid except if the parties have signed a written stipulation and agreed otherwise.

Source: pinkhamlaw.com

Source: pinkhamlaw.com

If your final not temporary alimony order was entered before January 1 2019 then your alimony payment may still be deducted from the alimony payors income and included in the alimony recipients income for federal. Increase in Spousal Support. According to a California court case In re Marriage of Reynolds 1998 a spouse paying spousal support pursuant to a California support order cannot be compelled to work after the standard retirement age of 65 in order to continue paying support at the same level heshe had been paying prior to reaching said standard retirement age. Changes to Laws - Changes to family law in California or State or Federal tax Laws could result in changes to spousal support payment amounts. In California the family courts have adopted a spousal support guideline for calculating temporary pre-judgment spousal support.

Source: kasparlugay.com

Source: kasparlugay.com

This includes people who have spousal or child support orders in place. Spousal support orders may be temporary or they be what is called permanent. How long does spousal support last in California The duration of support depends on how long the marriage has lasted and assumes a reasonable transition period from married life to single self-sufficient life. The Ability to Modify Spousal Support California Orders California Family Code Sections 3603 3651 c and 4333 provide that temporary as well as permanent spousal support awards and agreements can be modified during the period support is scheduled to be paid except if the parties have signed a written stipulation and agreed otherwise. If the spouses are on good terms they may mutually agree to modify the support amount.

Source: sdesquire.com

Source: sdesquire.com

Spousal support orders may be temporary or they be what is called permanent. When can you modify your spousal support order in California. A Request for Order is a motion wherein the requesting party requests that the Court order a specific ruling such as an increase in spousal support. The Ability to Modify Spousal Support California Orders California Family Code Sections 3603 3651 c and 4333 provide that temporary as well as permanent spousal support awards and agreements can be modified during the period support is scheduled to be paid except if the parties have signed a written stipulation and agreed otherwise. Spousal support which is not usually referred to as alimony in California is available in dissolution proceedings actions for legal separation and in connection with domestic violence applications.

Source: goldbergjones-sandiego.com

Source: goldbergjones-sandiego.com

In California the family courts have adopted a spousal support guideline for calculating temporary pre-judgment spousal support. Modifying Temporary Spousal Support Orders. California tax laws are not the same as federal tax laws about spousal support. How long does spousal support last in California The duration of support depends on how long the marriage has lasted and assumes a reasonable transition period from married life to single self-sufficient life. When to Request California Spousal Support Modification.

When to Request California Spousal Support Modification. The Ability to Modify Spousal Support California Orders California Family Code Sections 3603 3651 c and 4333 provide that temporary as well as permanent spousal support awards and agreements can be modified during the period support is scheduled to be paid except if the parties have signed a written stipulation and agreed otherwise. Anything or anyone saying California requires lifetime support is false. Changes to Laws - Changes to family law in California or State or Federal tax Laws could result in changes to spousal support payment amounts. If an agreement between the parties cannot be reached on the issue of a modification of spousal support the requesting party must file a Request for Order with the Court.

Source: cristinlowelaw.com

Source: cristinlowelaw.com

If your final not temporary alimony order was entered before January 1 2019 then your alimony payment may still be deducted from the alimony payors income and included in the alimony recipients income for federal. This form asks you to provide the information the judge will need to make a decision in your case addressing all the factors the law tells the judge to. If you are changing a spousal or partner support order made as part of your divorce or legal separation judgment or after the judgment it may be helpful for you to use the Spousal or Partner Support Declaration Attachment Form FL-157. That is because the court does not have the power to make any downward modification of spousal support unless you can show the court that there has been a material change of circumstance since the most recent order. Modifying Temporary Spousal Support Orders.

Source: yumpu.com

Source: yumpu.com

Changes to Laws - Changes to family law in California or State or Federal tax Laws could result in changes to spousal support payment amounts. The guideline states that the payor spouse should contribute presumptively 40 of his or her net monthly income reduced by one-half of. In California the family courts have adopted a spousal support guideline for calculating temporary pre-judgment spousal support. This California alimony calculator calculates California maintenance using the California county alimony formulas. If an agreement between the parties cannot be reached on the issue of a modification of spousal support the requesting party must file a Request for Order with the Court.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title spousal support modification california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Leatherman modification ideas

- Organizational behavior modification theory ideas

- Seamoth modification station location information

- Custody modification reasons information

- Kak shockwave modification information

- Subnautica cant place vehicle modification station information

- Loan modification while in chapter 13 information

- Behavior modification is based upon the principles of rewards and punishments advanced by ideas

- Modification lawyer information

- Z4 modification information