Wells fargo loan modification formula ideas in 2023

Home » modification » Wells fargo loan modification formula ideas in 2023Your Wells fargo loan modification formula images are available in this site. Wells fargo loan modification formula are a topic that is being searched for and liked by netizens today. You can Find and Download the Wells fargo loan modification formula files here. Find and Download all royalty-free images.

If you’re looking for wells fargo loan modification formula images information related to the wells fargo loan modification formula interest, you have come to the right blog. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

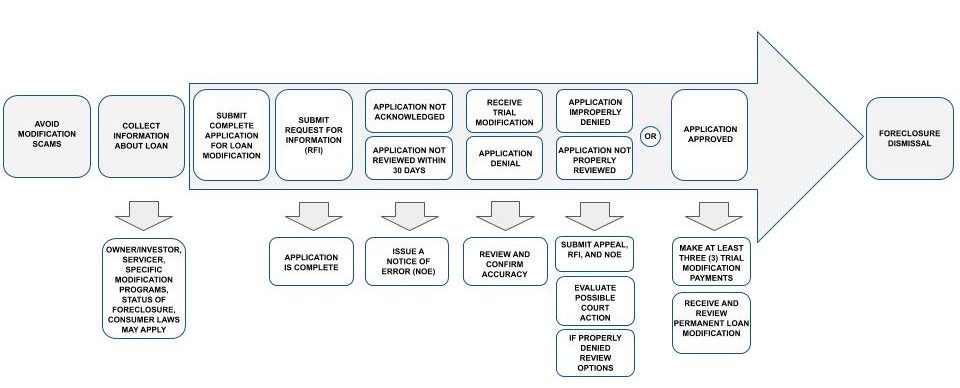

Wells Fargo Loan Modification Formula. The lawsuit which echoes the claims of a similar suit filed in December 2018 begins by explaining that under the Home Affordable Modification Program HAMP homeowners suffering financial hardship could be eligible to receive through their lender a mortgage modification to help stave off foreclosure by lowering monthly mortgage payments. If you decide to pursue the loan modification on your own you can use the same approach. Principal reduced to 115 LTV 30 yr PMMS rate 005 425 40 years. If the NPY of the modification would be greater than the NPY if there was no modification.

Https Www Wellsfargo Com Assets Pdf About Investor Relations Sec Filings 2019 Second Quarter 10q Pdf From

FONTquot housing debt ratio formula take income divided by housing dept mortgage payment hoa insuranceFONT FONTquot900 200 rule FONT FONTquotwells fargo use something called a 900 200 rule for calculating disposable. The mistake in a mortgage-modification tool discovered nearly three years ago wrongly factored lawyers fees into the formula put forth by the government to determine if a homeowner would qualify for a federally backed program like 2009s Home Affordable Modification Program or HAMP Wells Fargo revealed in a regulatory filing. The lawsuit which echoes the claims of a similar suit filed in December 2018 begins by explaining that under the Home Affordable Modification Program HAMP homeowners suffering financial hardship could be eligible to receive through their lender a mortgage modification to help stave off foreclosure by lowering monthly mortgage payments. This new modified payment is targeted to equal 38 of the homeowners gross monthly income. 165month - interest only - combined 325 Over-all DTI wliving is. Call 1-800-678-7986 to talk to us.

This is a new step part of the principal reduction alternative.

We based our decision on a faulty calculation and were sorry. However failed to answer specific questions which had a significant impact on the HAMP Net Present Value calculations. This new modified payment is targeted to equal 38 of the homeowners gross monthly income. Principal reduced to 115 LTV 30 yr PMMS rate 005 425 40 years. FONTquot housing debt ratio formula take income divided by housing dept mortgage payment hoa insuranceFONT FONTquot900 200 rule FONT FONTquotwells fargo use something called a 900 200 rule for calculating disposable. Submitting a pre-qualified and thoroughly loan modification application is the best way to get APPROVED as it should get you a faster and more favorable response by your lender.

Source: classaction.org

Source: classaction.org

4 Keep a Log Dont Rely on Your Memory One day they may tell you that the 4506-T has the wrong years and the next day you may speak to someone else that tells you that they reviewed it. Considering the fact that this initiative is essentially funded by your tax dollars you might as well make use of it and loan modification represents one of. All you have to do is input your financial data then MyCaal pre-qualifies your loan for a modification and suggests budget changes if necessary for pre-qualification. Modification for which they could qualify typically HAMP tier 2 or a FannieFreddie standard mod. You keep your original loan your original term and your original interest rate.

Source:

Reduce principal if principal reduction is offered. Discuss in detail the reasons for your hardship or default. 4 Keep a Log Dont Rely on Your Memory One day they may tell you that the 4506-T has the wrong years and the next day you may speak to someone else that tells you that they reviewed it. When calculating qualification for a federally backed program like 2009s Home Affordable Modification Program or HAMP legal fees and other bank collection costs are not added in to the formula denominator which consists of the loan balance. Ask you the amount of your annual gross income.

Source:

This report summarizes my attempt to obtain a HAMP loan modification from Wells Fargo Bank since 2012. If youve already started the loan modification process you may be. Full disclosure would bring the department in line with the Federal Deposit Insurance Corp which made public the NPV formula PDF developed for its loan modification. Modification for which they could qualify typically HAMP tier 2 or a FannieFreddie standard mod. HAMP tier 2.

Source: mosheslaw.com

Source: mosheslaw.com

When you were considered for a loan modification you werent approved and now we realize that you should have been. After attempts at negotiation and mediation they provided answers to some questions. As a HAMP servicer Wells Fargo was required. Submitting a pre-qualified and thoroughly loan modification application is the best way to get APPROVED as it should get you a faster and more favorable response by your lender. Heres a loan details both loans with Wells Fargo.

Source: wellsfargo.com

Source: wellsfargo.com

When calculating qualification for a federally backed program like 2009s Home Affordable Modification Program or HAMP legal fees and other bank collection costs are not added in to the formula denominator which consists of the loan balance. According to the lawsuit Wells Fargo reportedly sent out checks to borrowers who were wrongfully denied loan modifications along with letters that stated. If youve already started the loan modification process you may be. We based our decision on a faulty calculation and were sorry. If the NPY of the modification would be greater than the NPY if there was no modification.

Source: propublica.org

Source: propublica.org

This is a new step part of the principal reduction alternative. Ask you the amount of your annual gross income. But Wells Fargo decided to add-in attorneys fees and other costs which had the effect of disqualifying some homeowners who would have received loan modifications if the formula. Convert ARM loans to fixed rate fully amortizing loans. The Wells Fargo loan modification formula is utilized in their federal loan modification program which is designed to provide all qualifying homeowners with long-term financial relief through more affordable home loan payments.

Source:

But Wells Fargo decided to add-in attorneys fees and other costs which had the effect of disqualifying some homeowners who would have received loan modifications if the formula. When you were considered for a loan modification you werent approved and now we realize that you should have been. Discuss in detail the reasons for your hardship or default. A Wells Fargo loan modification can use a number of options to achieve a new mortgage payment that is affordable and meets the banks guidelines for approval. The Wells Fargo federal loan modification plan is designed to offer all eligible homeowners an affordable and sustainable mortgage payment.

Source: pinterest.com

Source: pinterest.com

If youve already started the loan modification process you may be. 62 - no principal included. HAMP tier 2. If you decide to pursue the loan modification on your own you can use the same approach. According to the lawsuit Wells Fargo reportedly sent out checks to borrowers who were wrongfully denied loan modifications along with letters that stated.

Source: wellsfargo.com

Source: wellsfargo.com

Full disclosure would bring the department in line with the Federal Deposit Insurance Corp which made public the NPV formula PDF developed for its loan modification. Discuss in detail the reasons for your hardship or default. All you have to do is input your financial data then MyCaal pre-qualifies your loan for a modification and suggests budget changes if necessary for pre-qualification. When you were considered for a loan modification you werent approved and now we realize that you should have been. Modification for which they could qualify typically HAMP tier 2 or a FannieFreddie standard mod.

Source:

All you have to do is input your financial data then MyCaal pre-qualifies your loan for a modification and suggests budget changes if necessary for pre-qualification. Modification versus the NPY of conducting no modification as to the same mortgage loan. After attempts at negotiation and mediation they provided answers to some questions. The lawsuit which echoes the claims of a similar suit filed in December 2018 begins by explaining that under the Home Affordable Modification Program HAMP homeowners suffering financial hardship could be eligible to receive through their lender a mortgage modification to help stave off foreclosure by lowering monthly mortgage payments. The mistake in a mortgage-modification tool discovered nearly three years ago wrongly factored lawyers fees into the formula put forth by the government to determine if a homeowner would qualify for a federally backed program like 2009s Home Affordable Modification Program or HAMP Wells Fargo revealed in a regulatory filing.

Source: wellsfargo.com

Source: wellsfargo.com

Call 1-800-678-7986 to talk to us. Principal reduced to 115 LTV 30 yr PMMS rate 005 425 40 years. Ask you the amount of your annual gross income. 62 - no principal included. The calculation ofNPY is arrived at using a proprietary formula developed by Wells Fargo.

Source:

Convert ARM loans to fixed rate fully amortizing loans. 62 - no principal included. We based our decision on a faulty calculation and were sorry. The calculation ofNPY is arrived at using a proprietary formula developed by Wells Fargo. The Wells Fargo federal loan modification plan is designed to offer all eligible homeowners an affordable and sustainable mortgage payment.

Source: wellsfargo.com

Source: wellsfargo.com

4685month - interest only - taxes insurance 31 of gross income 2nd. Heres a loan details both loans with Wells Fargo. 4 Keep a Log Dont Rely on Your Memory One day they may tell you that the 4506-T has the wrong years and the next day you may speak to someone else that tells you that they reviewed it. After attempts at negotiation and mediation they provided answers to some questions. 165month - interest only - combined 325 Over-all DTI wliving is.

Source: wellsfargo.com

Source: wellsfargo.com

This is a new step part of the principal reduction alternative. When calculating qualification for a federally backed program like 2009s Home Affordable Modification Program or HAMP legal fees and other bank collection costs are not added in to the formula denominator which consists of the loan balance. The basic principle is quite simple. The lawsuit which echoes the claims of a similar suit filed in December 2018 begins by explaining that under the Home Affordable Modification Program HAMP homeowners suffering financial hardship could be eligible to receive through their lender a mortgage modification to help stave off foreclosure by lowering monthly mortgage payments. Convert ARM loans to fixed rate fully amortizing loans.

Source:

This new modified payment is targeted to equal 38 of the homeowners gross monthly income. If youve already started the loan modification process you may be. Modification versus the NPY of conducting no modification as to the same mortgage loan. Full disclosure would bring the department in line with the Federal Deposit Insurance Corp which made public the NPV formula PDF developed for its loan modification. HAMP tier 2.

Source: hamprevisited.com

Source: hamprevisited.com

Heres a loan details both loans with Wells Fargo. This new modified payment is targeted to equal 38 of the homeowners gross monthly income. Reduce principal if principal reduction is offered. Discuss in detail the reasons for your hardship or default. The Wells Fargo federal loan modification plan is designed to offer all eligible homeowners an affordable and sustainable mortgage payment.

Source: metrickesq.com

Source: metrickesq.com

The only thing that changes is the principal of the loan. Get started with your specialist. A Wells Fargo loan modification can use a number of options to achieve a new mortgage payment that is affordable and meets the banks guidelines for approval. 165month - interest only - combined 325 Over-all DTI wliving is. The Wells Fargo loan modification formula is utilized in their federal loan modification program which is designed to provide all qualifying homeowners with long-term financial relief through more affordable home loan payments.

Source:

If you cant afford your current mortgage due to a financial hardship and you want to stay in your home we may be able to change certain terms of the loan such as the interest rate or the time allowed for repayment to make your payments more affordable. Call 1-800-678-7986 to talk to us. If you cant afford your current mortgage due to a financial hardship and you want to stay in your home we may be able to change certain terms of the loan such as the interest rate or the time allowed for repayment to make your payments more affordable. Do not include late fees in the unpaid balance. Modification versus the NPY of conducting no modification as to the same mortgage loan.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title wells fargo loan modification formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Leatherman modification ideas

- Organizational behavior modification theory ideas

- Seamoth modification station location information

- Custody modification reasons information

- Kak shockwave modification information

- Subnautica cant place vehicle modification station information

- Loan modification while in chapter 13 information

- Behavior modification is based upon the principles of rewards and punishments advanced by ideas

- Modification lawyer information

- Z4 modification information